estate tax changes for 2022

Now that we are firmly into 2022 there are a number of federal tax changes to consider before making gifts. See here for the sites reposting policy.

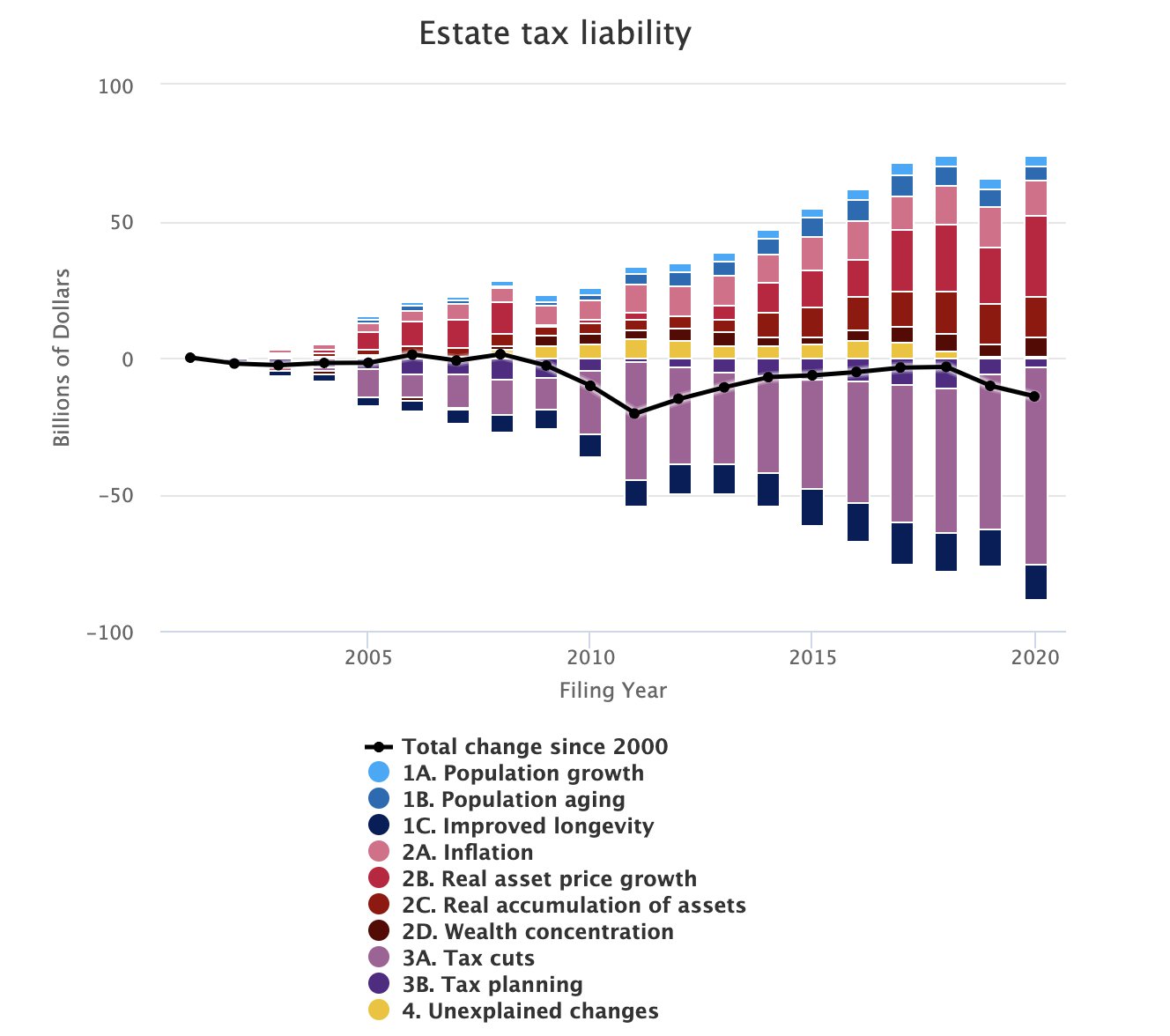

Ricco On Twitter Had Fun With This Project Where Exactly Did The Estate Tax Go We Run Simulations Holding Demographic Economic And Tax Related Factors Constant At Their 2000 Levels Which Lets Us

The annual gift exclusion increases to 16000 for calendar.

. Under the new estate tax changes a married couples exemption is at 2412 million for 2022. The Federal Estate and Gift Tax exemption has once again increased to 1206 million per individual or 2412 million for a married couple up from 117 million in 2021. The maximum tax credit drops to 35.

Get information on how the estate tax may apply to your taxable estate at your death. Here is what you need to know. Two key estate planning numbers will change effective January 1 2022.

Kinskey is one of six members of a joint conference committee. Lower Estate Tax Exemption. Here are the minimum income levels for the top tax brackets for each filing status in 2022.

The lifetime estate and gift tax exemption for 2022 jumped from 117 million to 1206 million. Covers rental property income and tax deductions. The IRS just announced important gift and estate tax changes for 2022 that youll need to know.

Under current law the federal estate tax exemption amount for 2022 is 118 million per individual but only until January 1 2026 when the exemption amounts will. As of the date of this article the. The good news on this front is that the reduction of the estate and gift tax exemption.

Had significant tax changes take effect on January 1st. Intuit will assign you a tax expert based on availability. Reduce the unified credit which.

These changes may impact you. The federal estate tax exemption for 2022 is 1206 million. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

Americans are facing a long list of tax changes for the 2022 tax year. Notably the IIJA does not. Use It or Lose It EstateGift Tax Exemption Cut in Half Effective January 1 2022.

Tax and Estates Alert. In November 2021 the IRS announced the revised federal estate tax and gift tax limits for 2022. This is not a substitute for legal advice.

Dave Kinskey R-Sheridan discusses legislation in Senate Chambers Monday March 7 2022 in Cheyenne. The Estate Tax is a tax on your right to transfer property at your death. New York Estate Tax.

Currently the allowed estate and gift threshold is 10000000 adjusted for inflation. See the latest 2022 state tax changes effective January 1 2022. This year the maximum credit allowed is up to 3000 per child and 6000.

Make changes to your 2021 tax return. The lifetime unified gift and estate tax exemption and the annual estate tax exclusion. Despite the large Federal Estate Tax exclusion amount New York States estate tax exemption for 2021 is 593 million.

CPA availability may be limited. Twenty-one states and DC. As of January 1 2022.

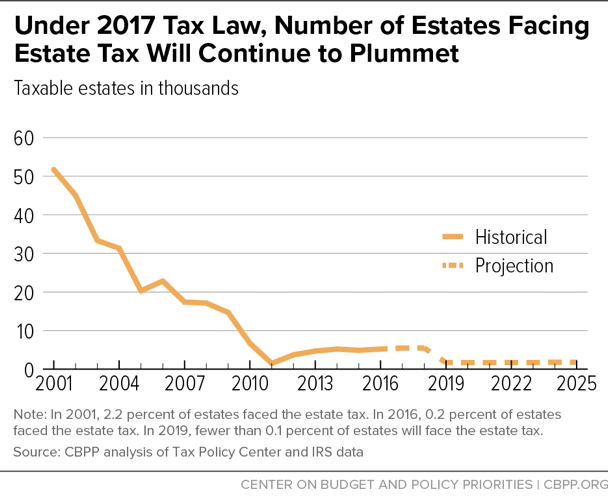

However it failed to include any of the initially proposed and anticipated changes to the current estate tax regime. For the 2022 tax year child and dependent care credits are non-refundable. Due to the steep amount of the estate tax exemption only 01 of American.

It consists of an accounting of. The estate tax exemption is often adjusted annually to reflect changes in inflation every year. In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax.

539901 up from 523601 in 2021 Head of Household. Which rooms do not have to be specified Created. Andreas Apetz The property tax return contains among other things the square.

1 day agoProperty tax 2022. Trusts and Estate Tax Rates of 2022.

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Estate Tax Landscape For 2021 And Beyond

Proposed Changes To Estate Tax Regulations Weaver

Inflation Pushes Income Tax Brackets Higher For 2022

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Attorney At Law 2022 Changes To Estate And Gift Tax Exclusions Announced Tbr News Media

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Estate Tax Changes Past Present And Future August 17 2022 Bessemer Trust

How Will Tax Law Changes Impact Your Estate Planning Larson Brown P A

District Of Columbia Tax Assessments Shows Signs Of Real Estate Market Recovery Otr

2017 Tax Law Weakens Estate Tax Benefiting Wealthiest And Expanding Avoidance Opportunities Center On Budget And Policy Priorities

2021 Tax Law Changes That May Affect You Estate And Probate Legal Group

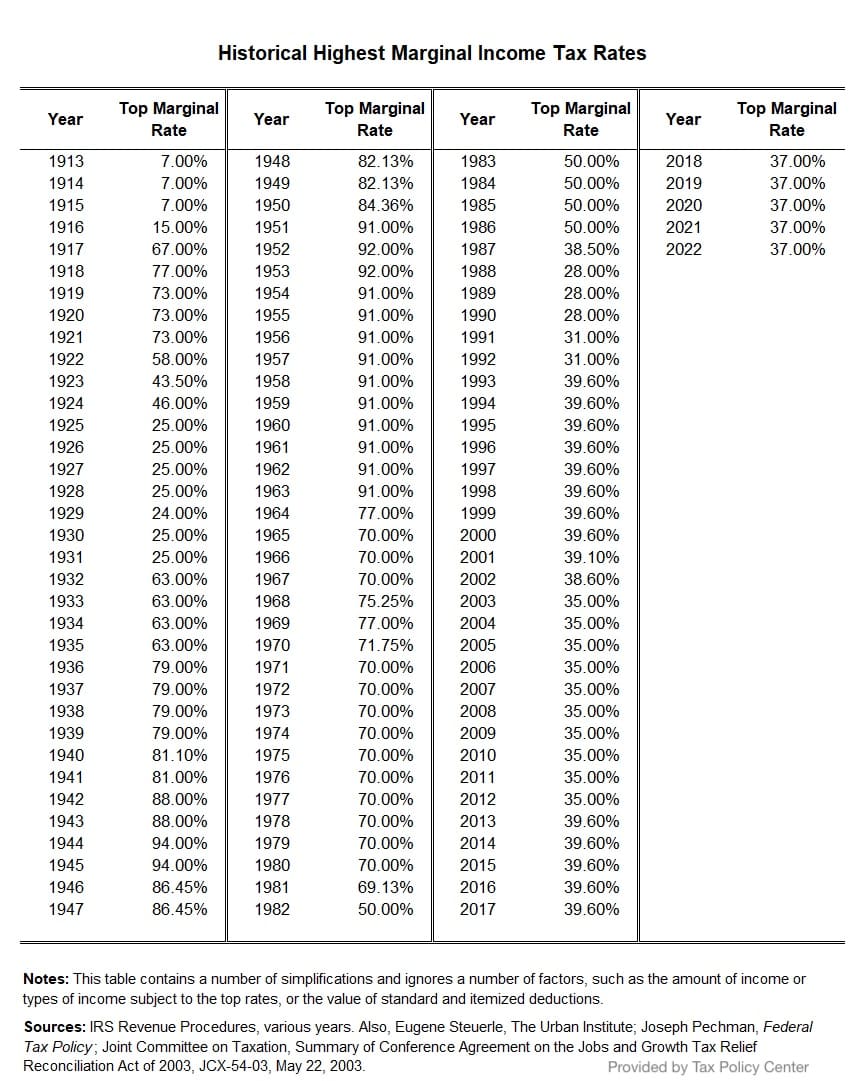

Income Tax History Tax Code And Definitions United States

Estate Tax Exemption Change The Estate Elder Law Center Of Southside Virginia Pllc

Major Estate Tax Changes Are Still Around The Corner Regentatlantic